Free Consultation

(314) 500-HURT100+ years of combined experience and over $200 million won for our clients in Missouri and Illinois. Contact a personal injury lawyer near you.

Free Consultation

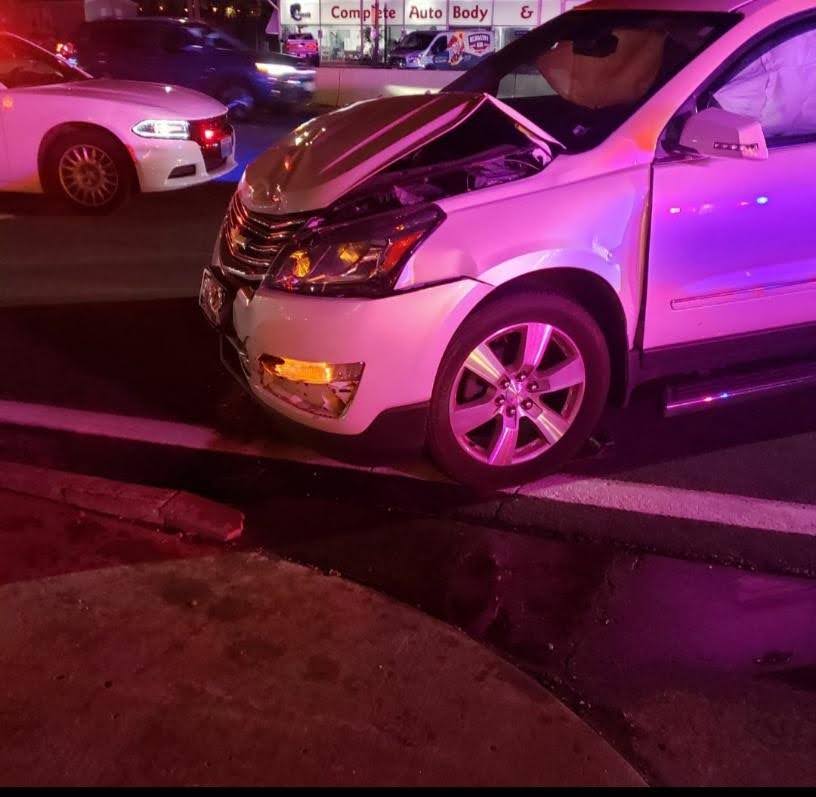

(314) 500-HURTGenavieve recently settled a phantom motorist claim for the stacked uninsured policy limits of $150,000. A phantom motorist claim arises when a negligent driver causes an accident, but you don’t know who the driver is.

Some examples include hit-and-runs, accidents caused by cargo following off of an unknown truck, or accidents caused by debris in the roadway. In these situations, you can file a phantom motorist claim through your own insurance policy’s uninsured motorist coverage.

Here, our client was a pedestrian lawfully crossing the street when she was hit by a car that fled the scene. We requested footage from nearby surveillance cameras but were ultimately unable to identify the at-fault driver.

Genavieve requested our client’s own car insurance declaration page to determine the amount of uninsured motorist coverage available if the at-fault driver could not be found. Genavieve noticed that two vehicles in the household were covered on the policy – one with $50,000 uninsured limits and one with $100,000 uninsured limits.

In Missouri, you can “stack” or combine uninsured motorist limits, so it is essential to investigate all potential sources of insurance coverage.

Genavieve confirmed that there were $150,000 in coverage limits available. Our client sustained a fractured shoulder and labral tear. Rather than undergo surgery, she pursued extensive physical therapy and had injections.

Ultimately she incurred approximately $58,000 in medical charges, with only about $11,000 paid and owed. Although our client had no immediate plans to get surgery, there was a possibility that she might elect to repair her labrum down the road.

Genavieve estimated that future arthroscopic labral repair, surgical anesthesia, and post-surgical physical therapy could cost approximately $48,000. Hence, she included those figures in the settlement demand letter to add value to our client’s claim.

She also had $13,816.00 in wage loss damages. Genavieve submitted a settlement demand for the $150,000 stacked policy limits with a 90-day deadline to respond.

On the 88th day, our client’s insurance company offered the full $150,000. If you are injured in an accident with a phantom motorist, Burger Law is happy to help navigate the insurance issues and do all we can to maximize the value of your claim. Call us now at (314) 500-HURT.

Founder | Injury Attorney

Gary Burger has dedicated his career to standing up against bullies. The founder and principal attorney of Burger Law | St. Louis Personal Injury Lawyer has helped hundreds of Missouri and Illinois individuals and families recover th …

Years of experience: 30 years

Location: St. Louis, MO

Similar Case Result

Genavieve recently obtained a $200,000 policy limits settlement for our client arising out of a car crash in St. Louis. Our client was traveling westbound on Forest Park Parkway...

We could all do with a simple reminder from time to time about the dangers of running or even slowly rolling through a stop sign or traffic light without coming to a stop ad waitin...

Genavieve recently obtained a $244,000 settlement for our client Aaron arising out of a car crash in Caseyville, Illinois. The at-fault driver negligently caused a horrible multi-v...

NO FEES UNTIL WE WIN YOUR CASE

We offer free consultations and are available 24/7 to take your call. Live chat, text, and virtual meetings are available.

or call us at