Free Consultation

314-542-2222100+ years of combined experience and over $200 million won for our clients in Missouri and Illinois. Contact a personal injury lawyer near you.

Free Consultation

314-542-2222We recently had great success in a hard-fought battle against an insurance company. What is amazing about this case

is we got around a settlement that the insurance company tried to trick her into.

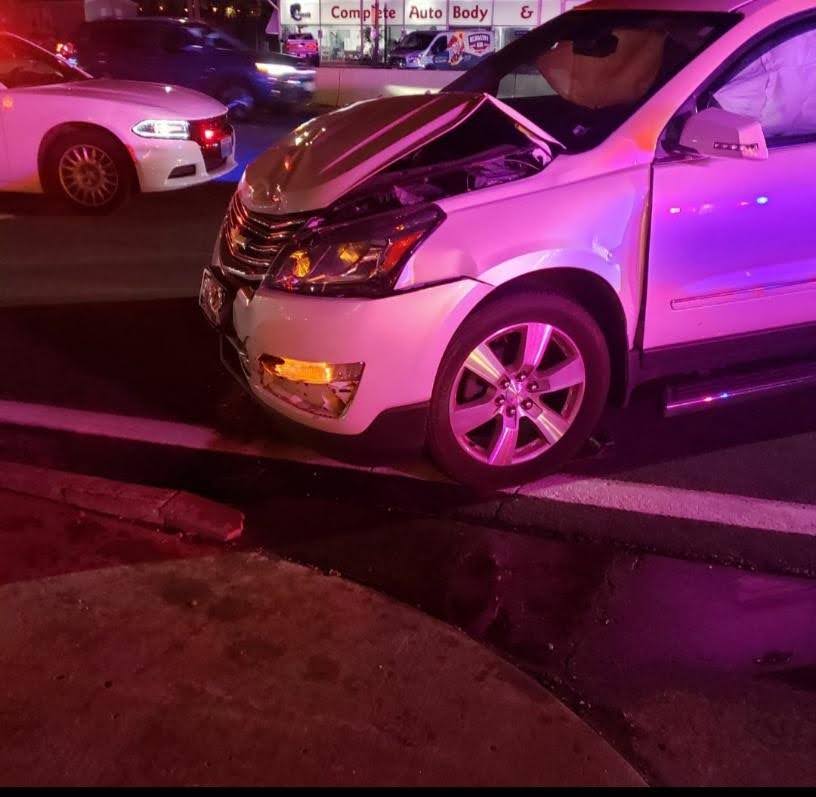

Aarti was rear-ended and suffered severe injuries to her neck and right arm. She ultimately required surgery, and the

total medical was over $40,000.

One week after the accident, the at-fault driver’s insurance company tried to settle the claim with Aarti over the

phone before she knew the full extent of her injuries. They offered $260 for full settlement and agreed to pay for

medical bills up to $2,000.

The insurance company then sent Aarti a letter saying she agreed to settle her injury claim for $260 and asked her to

sign a release. Aarti cashed the check because she believed it was partial payment for her medical bills, not the

settlement of her claims.

However, she did not sign the release.

After taking the case, the insurance company told us Aarti already settled her claim in full for $260. We disputed

this and filed a lawsuit. The defendants raised the affirmative defense of accord and satisfaction, asserting that

the dispute had been settled when Aarti cashed the check.

Under Missouri law, when an insurance claim involves a genuinely disputed amount, and the insured accepts in

settlement of that claim-a draft designated as payment in full, an accord and satisfaction results. Clark v. Trader

Ins. Co., 951 S.W.2d 750, 754 (Mo. App. 1997).

Missouri law agrees that where a claim is unliquidated or in dispute, a check has been tendered on the express

condition that acceptance thereof shall be deemed to be satisfied in total, and where the payee cashes the check, an

accord and satisfaction results. Id.

We rejected the defense of accord and satisfaction. During discovery, the defendants served requests for admissions

attempting to get Aarti to admit that she settled her claim for $260, which we denied.

We asserted that the check was not for full settlement but rather partial payment for Aarti’s medical treatment.

After written discovery was completed, the defendants offered Aarti the policy limits of $50,000.

This case was a big win, and we were happy to help Aarti with this misleading claim.

This is why we do what we do – fight unscrupulous insurance companies trying to trick people.

Founder | Injury Attorney

Gary Burger has dedicated his career to standing up against bullies. The founder and principal attorney of Burger Law | St. Louis Personal Injury Lawyer has helped hundreds of Missouri and Illinois individuals and families recover th …

Years of experience: 30 years

Location: St. Louis, MO

Similar Case Result

Genavieve recently obtained a $200,000 policy limits settlement for our client arising out of a car crash in St. Louis. Our client was traveling westbound on Forest Park Parkway...

We could all do with a simple reminder from time to time about the dangers of running or even slowly rolling through a stop sign or traffic light without coming to a stop ad waitin...

Genavieve recently obtained a $244,000 settlement for our client Aaron arising out of a car crash in Caseyville, Illinois. The at-fault driver negligently caused a horrible multi-v...

NO FEES UNTIL WE WIN YOUR CASE

We offer free consultations and are available 24/7 to take your call. Live chat, text, and virtual meetings are available.

or call us at