Free Consultation

(314) 500-HURT100+ years of combined experience and over $200 million won for our clients in Missouri and Illinois. Contact a personal injury lawyer near you.

Free Consultation

(314) 500-HURTOur fight just for our clients doesn’t always stop with the liable party in our clients’ claims. Unfortunately,

sometimes you’re involved in an accident and there isn’t enough coverage in the liable party’s coverage to fully

compensate an injured party for their injuries. In theses instances, it is always good to make sure that you have

underinsured motorist coverage, as our client did.

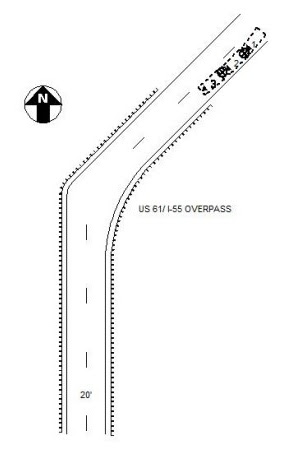

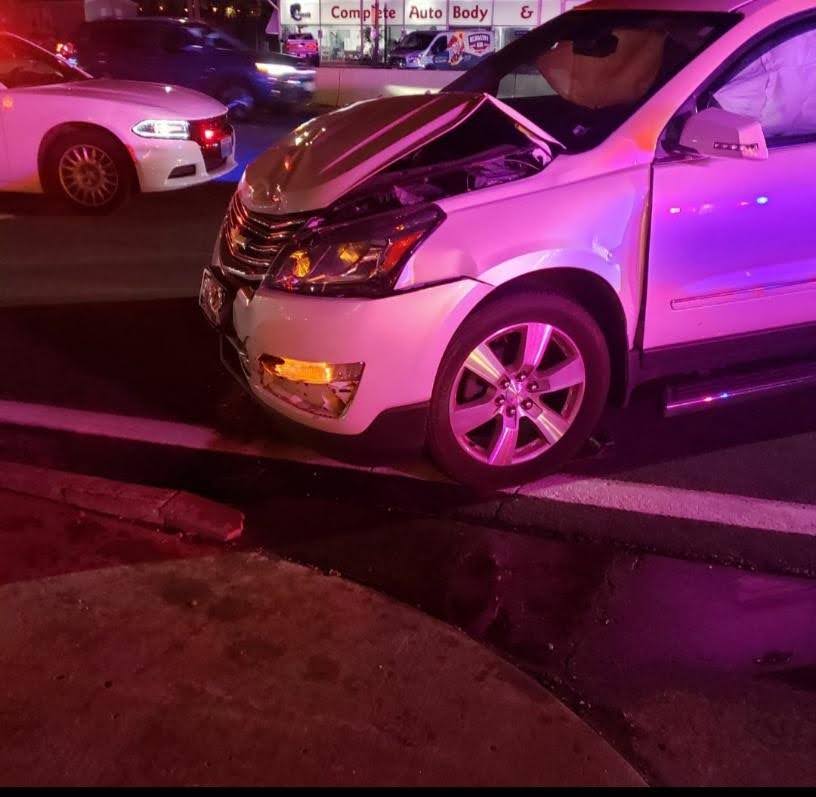

Mrs. Bixler was a passenger in the vehicle her husband was driving when they were rearended so forcefully

that it pushed their vehicle into the one in front of them. Mrs. Bixler sustained injuries to her cervical

and lumbar spine, back, neck, shoulder, and elbow. Our client went to her primary care physician who

referred her out for treatment.

She had MRI’s and was diagnosed with various disc disorders. She went through multiple rounds of therapy and

rehabilitation treatment, multiple injections and has now been recommended for an anterior cervical

discectomy and fusion. This surgery and subsequent treatment alone will cost roughly $100K.

As we do for all our clients, we thoroughly investigated the insurance coverage applicable to Mrs. Bixler’s accident.

Even though Missouri law requires every driver to have auto insurance with minimum bodily injury liability coverage

of $25K, often drivers are underinsured. We were able to obtain the policy limits of $50K from the liable party, but

we did not stop there. We discovered an additional $50K in coverage underinsured coverage in her policy and made a

demand for that amount for Mrs. Bixler.

Not only did attorney Grant Doty recover the full policy limit against the liable party, he pushed even hard

for our clients and was not only able to obtain the full policy limit of both covered parties but also

assist in our client’s recovery of her medical payments coverage.

Mrs. Bixler’s case is a primary example of why it is so important to review the declarations page of your

insurance coverage so that you know exactly what type of coverage that you have. In cases like this, where

our clients’ damages exceed the liable party’s available limits, it is imperative to know if you have any

additional coverage such as underinsured coverage or medical payments coverage to help compensate you for

your injuries. Unfortunately, the at fault party doesn’t always carry enough coverage, so it’s always best

advised to make sure to protect yourself!

In addition to Mrs. Bixler’s claim we were also able to settle her husband’s claim from the same accident. We were

grateful for the opportunity to represent them and wish them the best in the future.

Founder | Injury Attorney

Gary Burger has dedicated his career to standing up against bullies. The founder and principal attorney of Burger Law | St. Louis Personal Injury Lawyer has helped hundreds of Missouri and Illinois individuals and families recover th …

Years of experience: 30 years

Location: St. Louis, MO

Similar Case Result

Genavieve recently obtained a $200,000 policy limits settlement for our client arising out of a car crash in St. Louis. Our client was traveling westbound on Forest Park Parkway...

We could all do with a simple reminder from time to time about the dangers of running or even slowly rolling through a stop sign or traffic light without coming to a stop ad waitin...

Genavieve recently obtained a $244,000 settlement for our client Aaron arising out of a car crash in Caseyville, Illinois. The at-fault driver negligently caused a horrible multi-v...

NO FEES UNTIL WE WIN YOUR CASE

We offer free consultations and are available 24/7 to take your call. Live chat, text, and virtual meetings are available.

or call us at